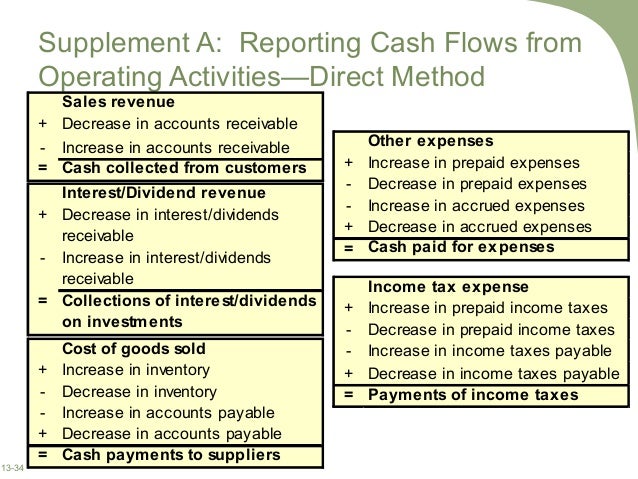

The decrease in accounts payable of $919 is then added to the amount of the purchases of $71,057 to calculate the cash paid to suppliers of $71,976. To determine the amount that has actually been paid for the merchandise purchased, a second step is needed. Because the amount paid for merchandise includes what was sold as well as what still remains on hand in inventory to be sold, the change in inventory effects the cash payments to suppliers. An increase in inventory means a company purchased more than it sold. First, the $107 increase in the inventory account is added to the amount of cost of goods sold-found on the income statement-of $70,950 to get $71,057 as the cost of goods purchased. It takes a two‐step calculation to determine the cash payments to suppliers of $71,976. This represents the amount paid by the company for merchandise it plans to sell to its customers. If the accounts receivable balance had increased, the cash collected from customers would be determined by subtracting the increase in the accounts receivable balance from the sales balance because an increase in accounts receivable means your customers owe you the cash for their purchases (your sales).Ĭash payments to suppliers. The $663 decrease is added to sales per the income statement of $129,000 to determine the cash collections from customers reported in the cash flow statement of $129,663.

Accounts receivable decreased by $663 because the company received more cash from its customers than credit sales made by the company. The activity in the accounts receivable and sales accounts is used to determine the cash collections from customers. To prepare the operating activities section, certain accounts found in the current assets and current liabilities section of the balance sheet are used to help identify the cash flows received and incurred in generating net income.Ĭash collections from customers This consists of sales made for cash (cash sales) and cash collected from credit customers. Table summarizes many cash activities and the related financial statement accounts used to analyze each listed activity. Similarly, if cash decreases, there may be an increase in another asset account, such as inventory (purchase of inventory) or equipment (purchase of equipment), a decrease in a liability account, such as accounts payable (payment to creditor) or notes payable (payment on loan), or an increase in an expense account (payment to vendor). If cash increases, that increase may also decrease another asset account, such as accounts receivable (payment from customer on account) or equipment (sale of equipment), or increase the sales account (cash sales). If cash increases or decreases, at least one other account also changes. Remember that in accounting, all transactions affect at least two accounts.

Therefore, the statement of cash flows is prepared by analyzing all accounts except the cash accounts. Most companies record an extremely large number of transactions in their cash account and do not record enough detail for the information to be summarized. Preparing the statement of cash flows using the direct method would be a simple task if all companies maintained extremely detailed cash account records that could be easily summarized like this cash account:

The discussion on the direct method of preparing the statement of cash flows refers to the line items in the following statement and the information previously given. The Cost of Goods Manufactured Schedule.Managerial and Cost Accounting Concepts.Financial Statement Analysis Limitations.Preparing the Statement: Indirect Method.

Balance Sheet: Classification, Valuation.The Balance Sheet: Stockholders' Equity.

0 kommentar(er)

0 kommentar(er)